Hemp on the Rebound?

Its Initial Boom Was Swiftly Followed by a Big Bust. Is Hemp Now Poised for a Comeback?

While the markets for all types of hemp took a hit in recent years, hemp grown for fiber is attracting more interest, entrepreneurs, and comparative acreage. While the future of CBD hemp remains uncertain, more products are coming on the market for fiber hemp, and new cultivars are being developed that keep CBD and THC to a minimum in fiber and grain hemp. While each state has its own story to tell, the worst of the hemp crash may be over.

On Apr. 19, 2023, the USDA released its 2022 National Hemp Report. But David Suchoff, who began working with the unique crop at North Carolina State University (NC State) in 2019, didn’t have to read it to know the bottom line: Hemp production was down. Way down.

“It was a bubble,” says ASA and CSSA member David Suchoff, an assistant professor and alternative crops extension specialist in NC State’s Department of Crop and Soil Sciences. “And that bubble has burst.”

It burst, to be precise, by almost half in acreage (down to 28,314 acres from 54,152 in 2021) and by even more—71%—in value (down to $238 million from $824 million). It was a precipitous drop for a plant that had cropped up (so to speak) on the agricultural scene to much hubbub just a few years before with estimates of more than 250,000 acres planted in 2019.

Though cultivated since the Bronze Age, hemp and its cousin marijuana had both been largely absent from U.S. farms for a century, regulated under the U.S. Controlled Substances Act. Although the cousins are essentially the same plant—Cannabis sativa—marijuana contains higher levels of tetrahydrocannabinol (THC), the ingredient behind the drug’s “high.” With far lower levels of THC, hemp induces no psychoactive effects and is instead grown for its fibers, grain (also called hemp seeds), and cannabidiol (CBD)‐containing flowers. (Hemp is sometimes specified as “industrial hemp” to underscore its distinction from marijuana; some use “industrial hemp” more specifically to distinguish grain and fiber hemp from CBD hemp.)

But when the 2018 farm bill took hemp off the U.S. Drug Enforcement Administration’s Schedule I list, a flood of interest in and funding for the newly decriminalized crop followed. For researchers like Suchoff, whose job was created in 2019 as the boom crested, it was a unique opportunity.

“It’s new in the sense that we really are starting from scratch in developing a lot of these cultural practices,” Suchoff says. The agricultural community had the chance to farm this new crop sustainably from the start, and scientists had a literal and figurative field day in unchartered research territory.

But those research voids also proved to be pitfalls for some who hopped early on the hemp bandwagon: They had little to guide them on fertilization, pest control, THC and CBD levels, hemp markets, and performance of foreign cultivars in their fields.

Ultimately, many producers who placed their hope in hemp had backed out by last year as the latest National Hemp Report documents. But now, having worked through some painful hiccups, hemp production is on the rebound, according to some in the field. Scientists are publishing new findings, breeders are cooking up new cultivars, lawmakers are reconsidering regulations, and “hempreneurs” are developing new products, processing infrastructure, supply chains, and markets.

The U.S. has much catching up to do before approaching the output of China, the world’s largest producer. “We are behind in so many things because we just started,” says ASA and CSSA member Hardev Sandhu, an associate professor of agronomy at the University of Florida (UF). “So, this information is now coming in pieces.”

In the U.S., the hemp landscape can differ considerably from state to state, based on latitude, suitability of available cultivars, infrastructure, regulatory environment, commodity crops, and other factors. Colorado has weathered one of the most dramatic boom/bust cycles. Florida, as discussed further below, and other southern states face a latitude problem. Oregon’s focus on floral hemp has put constraints on growing other types, as ASA and CSSA member Jeffrey Steiner, director of the Global Hemp Innovation Center at Oregon State University, noted in his 2021 overview of the crop in Crops & Soils magazine (https://doi.org/10.1002/crso.20124).

Still, given new insights into THC biochemistry, advances in breeding, adjustments to market realities, and other signs of progress, hemp may yet live up to its hype.

From Floral to Fiber

Hemp pilot programs began popping up across the U.S. soon after they were authorized by the 2014 farm bill, allowing the ag community to dip a toe into the long‐verboten plant. After the 2018 farm bill reclassified hemp from drug to crop and many states had passed laws paving the way for producers, that advance guard waded in deeper. Sugarcane producers in Florida tested it as a rotation crop. North Carolina growers seeking alternatives to tobacco also gave it a go. Some were just drawn by the crop’s novelty.

Farmers had their choice of different kinds of hemp. According to the latest National Hemp Report, about 11% of hemp grown in 2021 in the open (a small percentage of hemp is also grown in greenhouses) was for grain, which can be used in some food products; about 57% was fiber hemp, suitable for building materials and animal bedding.

But generating the most buzz in the early years was floral hemp—35% of 2021’s crop—valued for its CBD content. One of numerous cannabinoids found in hemp flowers (THC being the most well‐known), CBD has been touted for its health benefits and incorporated into oils, gummies, lotions, sports recovery drinks, and other products. Early on, the potential for using CBD in a wide array of products seemed promising, and hemp flower was fetching a good price.

But the tide had already started to turn for floral hemp back in by 2019, and by 2022, what one CBD CEO characterized as a “gold rush period” was history. As it turned out, growers produced much more CBD hemp than they could sell. By 2022, the price had fallen 27% from the previous year, and farmers were saddled with heaps of unwanted hemp.

“I don’t think a lot of processors realized how relatively easy it is to produce this crop,” NC State’s Suchoff says, “and how much CBD you can actually get out of a plant, which is quite a lot.”

While CBD was cropping up in products purporting to assuage anxiety, insomnia, and other troubles, the predicted explosion of CBD medical uses did not materialize. The U.S. Food and Drug Administration (FDA) has, as of this writing, approved CBD for medical use in a grand total of one product, a drug for severe epilepsy green‐lighted back in 2018.

Regulatory uncertainty has held the CBD market back, says plant breeder and CSSA member Larry Smart, a professor in Cornell University’s School of Integrative Plant Science. Unless the FDA allows CBD into a broader range of consumer products, the current market supports no more than 10,000 acres of CBD hemp production nationally, says Smart, who leads Cornell’s hemp research and extension team. “It’s really only going to support a small number of growers.”

But while the outlook for floral CBD seemed to fade, prospects for fiber hemp appeared rosier. While floral hemp production fell by 66% from 2021 to 2022, according to the USDA report, fiber hemp production fell by much less, 37%, while total retted fiber hemp fell by 17%. Fiber hemp growers sold almost all their retted production in 2022, compared with only 63% the year prior, with the price per retted pound jumping 35% and the value of utilized retted production up 90%.

That tracks with Suchoff’s observations. “We’re seeing tremendous interest in fiber hemp,” he says, attributing part of that to the legacy of North Carolina’s textile industry. The growth of hemp‐based building products, including flooring, insulation, and “hempcrete,” is evidence of an expanding market for farmers.

In short, the industry has been shifting from CBD hemp and toward fiber hemp, as USDA statistics bear out: In 2022, fiber accounted for 69% of all hemp grown in the open (up from 55% in 2021) while floral’s share dipped from 34 to 22%.

A plummeting market wasn’t the only problem facing floral hemp. Growing CBD‐rich flowers that don’t contain too much THC turned out to be a precarious practice.

As it turned out, growers produced much more CBD hemp than they could sell. By 2022, the price had fallen 27% from the previous year, and farmers were saddled with heaps of unwanted hemp.

Walking the THC Tightrope

Whether they grow it for grain, fiber, or CBD, all hemp farmers want as little THC in their product as possible, and certainly no more than 0.3%. Hemp that tests above that level is, legally, no longer hemp: It’s marijuana. Often those plants are destroyed, a big hit for farmers. In 2020, 13% of Iowa’s crop was destroyed for that reason; in Indiana, it was 20%. Out‐of‐compliance hemp is one big reason why more than half of all hemp acres planted in both 2021 and 2022 were not harvested although USDA rules now allow for procedures to mitigate and retest a non‐compliant harvest.

Whether they grow it for grain, fiber, or CBD, all hemp farmers want as little THC in their product as possible, and certainly no more than 0.3%.

Hemp producers’ goals diverge when it comes to CBD: While grain and fiber hemp farmers aim for low levels of that compound, CBD hemp growers want as much cannabinoid as their plants will crank out—while of course keeping THC levels out of marijuana range. For a while, breeders tried to walk that tightrope by developing cultivars with high CBD but low THC. But they ran smack into a biochemical wall: The two, it turns out, are coupled.

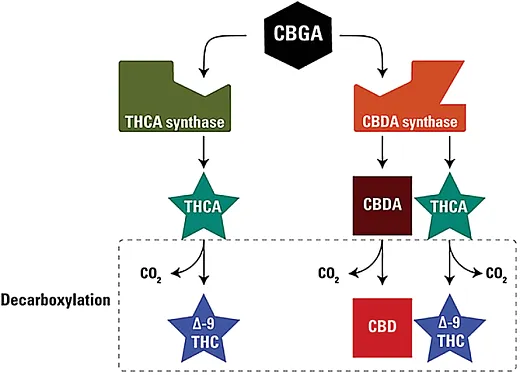

To understand this better, we need to dive into hemp at the molecular level—while staying afloat in the attendant alphabet soup. Both THC and CBD are derived from the acid form of a third cannabinoid called cannabigerol (CBG). When this acid, CBGA, interacts with the enzyme THC synthase, it leads to the creation of THC. When CBGA interacts with CBD synthase, you end up with—you guessed it—CBD.

But unfortunately for breeders who hoped to create low‐THC, high‐CBD cultivars, it’s not the full story. Because CBD synthase, being the promiscuous enzyme that it apparently is, can also beget THC (see illustration this page). In short, if you boost CBD levels, THC will creep up right alongside its cannabidiol cuz. Wiping out THC synthase is essential to breed compliant hemp, but it won’t make THC go away.

Production of CBD and THC kicks into high gear as CBD hemp begins to flower, peaking from three to six weeks after terminal flowering begins, depending on the cultivar. (The compounds are concentrated in flowers of female plants with lesser amounts in leaves and male plants and far lower levels in grain and stalks.) But the two cannabinoids are synthesized at different rates with about 26 CBD molecules to every THC. By the time a plant nears the 0.3% THC limit, according to Suchoff, total CBD content is about 6 to 7%.

This coupling is less of a hurdle in countries where THC limits are higher (1% in Switzerland, for example). But in the U.S., where hemp breeding and research are still in the early stages and many imported cultivars produce too much THC, scientists are running up against challenging constraints. This has been especially so in the southern U.S. where cultivars of this photosensitive plant that were developed in northern latitudes flower too early, resulting in too much THC and/or too little biomass as we’ll see shortly.

On the other hand, fiber and grain hemp producers are not shooting for high CBD: There’s no point in imbuing a building block with health benefits, and low CBD helps them steer clear of regulatory hassles. That’s a particular concern for grain hemp growers advocating their product’s use in livestock feed, currently prohibited by the FDA.

Some years ago, breeders in Ukraine developed hemp cultivars devoid of all cannabinoids, according to Cornell’s Smart. But when he tested those cultivars in the U.S., they proved susceptible to certain herbivore pests.

“Taking that strategy of totally eliminating cannabinoids is probably not wise because you are removing one of the defenses that has evolved in Cannabis sativa,” says Smart, who has an upcoming paper on cannabinoids’ toxicity.

Let’s take a closer look at some of the setbacks and successes of scientists tackling these problems.

When You’re Hot, You’re Not Hemp (Anymore)

In summer, Florida can get pretty steamy. But for Sunshine State hemp growers, it’s not the day’s heat that is the problem; it’s the crop’s heat. Hemp “goes hot,” according to the lingo, when THC surpasses legal limits.

The University of Florida’s Sandhu ran into this problem when, funded by sugar companies, he tested several CBD hemp cultivars in south Florida in the summer of 2020. Sugarcane is a multiyear perennial, and the companies wondered if hemp could be grown as a rotation crop during the summertime niche between plantings when the land would otherwise lie fallow. Sandhu and his research team tested seven cultivars, staggering plant dates by a few weeks.

“We were trying to find if, within these six months, we can play with the planting date, come up with an ideal date which is better than the other ones,” Sandhu explains.

Florida had no homegrown cultivars, so Sandhu had to go shopping in more hemp‐forward states, specifically Colorado and Kentucky.

Of course, conditions in Belle Glade, FL, differ significantly from, say, Fort Collins, CO. A Colorado cultivar might, for example, begin to flower there in mid‐August, triggered by days shortening to 13.5 hours. But in Belle Glade, that daylength arrives weeks earlier. At flowering, the THC clock starts ticking; within a few weeks, it will reach the legal limit. That doesn’t give the Belle Glade plant much time to beef up.

As Sandhu and his co‐authors reported recently in Agrosystems, Geosciences & Environment (https://doi.org/10.1002/agg2.20347), the results showed that planting date generally had little effect on the relative proportion of CBD and THC or on CBD concentration and floral biomass yield. This may have been in part because the planting dates tested were relatively close together—they had to fall within the narrow window during which cane producers would conceivably plant them, Sandhu explains. Cultivars adapted in Kentucky had more floral biomass and CBD yield than those from Colorado, evidence that the differences were driven by genetics, not planting dates.

But almost all cultivars had one thing in common: By maturity, the hemp had gone hot. “It flowers within a month, and you don’t get enough flowers at that time,” Sandhu explains. “But you have to just harvest it—and that’s not economical for growers.”

Sandhu’s colleague Zachary Brym, an assistant professor in UF’s Institute of Food and Agricultural Sciences, has come to know such obstacles well.

“One of the things that I’ve become very comfortable with is describing the copious number of challenges of growing hemp,” says Brym, an ASA and CSSA member who oversees UF’s hemp program. “We’ve got to match a variety and cropping system to our unique growing environment.”

“One of the things that I’ve become very comfortable with is describing the copious number of challenges of growing hemp,” says Brym, who oversees UF’s hemp program. “We’ve got to match a variety and cropping system to our unique growing environment.”

On top of the daylength problem, Florida’s mostly sandy, rocky soils have little to offer in the way of organic matter, moisture, or nutrition. South Florida has not been hospitable, says Brym, while central Florida (where farmers are looking for alternatives to in‐decline citrus) and north Florida are proving more hemp friendly.

Brym studies what management practices can benefit hemp; in a recent Agronomy Journal review, he and his coauthors discuss the many positive effects of nitrogen fertilizer while calling for more research to inform a sustainable nutrient management program (https://doi.org/10.1002/agj2.21345).

In line with the national trend, floral hemp production was down in Florida by more than 60% from 2021 to 2022. Farmers trying to maximize biomass and minimize THC must tread “an uncomfortable middle ground,” Brym says. Per USDA guidelines, hemp must be harvested no more than 30 days after THC field testing. “So, there’s a game, right?” Brym says. “You take your test at the latest possible scenario that you’re going to pass 0.3%, and then you’re going to wait the 30 days to harvest.”

No matter where farmers live, it’s a tough hit when they misjudge the timing of THC field testing and end up with a hot crop: In ag as in life, sometimes the bear eats you. But with the right research backing you up, sometimes you get to eat the bear.

Breeders Bear Good News

Smart, the Cornell breeder, began grappling with the high‐THC problem a few years ago. Intent on breeding low‐THC cultivars, he began working with germplasm from reigning hemp champ China.

“One thing we learned pretty early on in testing Chinese varieties is that the breeders there have not been selecting for low‐THC production,” Smart says. “Originally all 13 of the Chinese lineages that we tested were predominantly making THC instead of CBD.”

Rather than approach the problem through conventional breeding—repeatedly crossing cultivars while observing how offspring perform—Smart’s team took the faster and more efficient approach of examining the offspring’s genetic makeup.

“We have developed molecular markers that help us distinguish those two,” Smart says of the genes associated with CBD and THC, “and we have been using marker‐assisted selection to remove the genes for THC production in those lines.”

Their work has led to two very low‐THC hemp cultivars on which Smart has bestowed the trademark Ursa, a nod to Touchdown the bear, Cornell’s unofficial mascot. Both have performed well across test sites, reports Smart: Even in lower latitudes of Florida, Texas, and Arizona, the plants produce zero or nondetectable THC. Ursa Alta is a fiber hemp cultivar while Ursa Grande is dual purpose (fiber and grain) in most climates, says Smart, adding that both are slated to go on the market by 2024.

Smart has other breeding targets in his sights, including a CBD hemp plant that will flower later in Florida and grain hemp (which has a feed value akin to alfalfa’s) that will more easily meet U.S. regulatory guidelines for animal feed. Hoping to make hemp better people food, as well, he is developing a line of grain hemp that will make the plant’s notoriously insoluble protein soluble. That could open the door to using more hemp in powders, plant‐based meat, and other foods.

There are lots of signs that hemp is indeed making a comeback. But will farmers come back to hemp?

“We have developed molecular markers that help us distinguish [between genes associated with CBD and THC] and we have been using marker-assisted selection to remove the genes for THC production in those lines.”

Is Hemp Over the Hump?

Many growers remain wary, says NC State’s Suchoff. “Because so many farmers got burned with CBD hemp, they’re very hesitant now to get involved in anything called hemp,” he says. “I think a lot of folks are waiting to see success.”

Easing regulations could pave the way to that success, and many voices are advocating for that. Legislation introduced in Congress in March 2023 would exempt grain and fiber hemp from THC testing. There is also talk that this year’s farm bill will raise the percentage of THC allowed in all hemp to 1%.

“A 1% limit would make essentially all CBD hemp compliant,” Smart notes.

Smart also sees a lot of potential for farmers to earn carbon credits by switching to hemp. Producing fiber and building materials with hemp releases far fewer greenhouse gases than the conventional products they would replace, and hemp products sequester carbon in useful packages.

“If you grow hemp and then make it insulation and sock it away in your wall for decades and decades, that is pulling CO2 out of the air in a very obvious way,” Smart says. “Likewise, if you sink hempcrete into the walls of your house, it’s sequestering carbon for as long as that wall stands.”

The industry still has to go through some “invest and catch up” cycles as crop production, hemp‐processing capacity, and the market begin to align better, Smart says.

“Once we have some companies out there … showing that it can be done, and we get the carbon markets going and farmers start making a profit by sequestering carbon,” Smart says, “then I think the whole industry is just going to accelerate.”

DIG DEEPER

View the research mentioned in this article:

“Cannabidiol Industrial Hemp Growth, Biomass, and Temporal Cannabinoids Accumulation Under Different Planting Dates in Southern Florida,” published in Agrosystems, Geosciences & Environment: https://doi.org/10.1002/agg2.20347

“Nitrogen Fertilization Impact on Hemp (Cannabis sativa L.) Crop Production: A Review,” published in Agronomy Journal: https://doi.org/10.1002/agj2.21345

Steiner, J. (2021), Making Hemp a 21st Century Commodity in Oregon—and Beyond. Crops & Soils Mag., 54: 24–31. https://doi.org/10.1002/crso.20124

Text © . The authors. CC BY-NC-ND 4.0. Except where otherwise noted, images are subject to copyright. Any reuse without express permission from the copyright owner is prohibited.